Lyon double whammy – off form-fiscal woes

Article posted by Coliseum,Share this article:

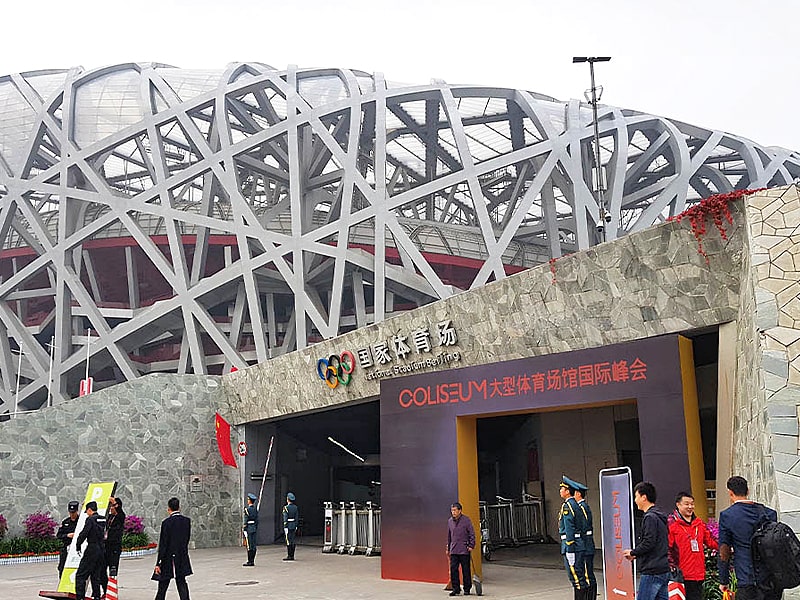

Image: Olympique Lyonnaise

Image: Olympique Lyonnaise

The Ligue 1 team Olympique Lyonnais is seeking to raise about €300mn from the bond market and is selling some of its assets including a new 16,000-seater arena as the French football club’s US owner looks to reorganize its finances following last year’s record-breaking takeover.

‘FINANCIAL TIMES’ stated that John Textor’s (American businessman) Eagle Football Holdings acquired Lyon in December last year at a valuation close to €900mn, by far the highest price ever paid for a French team and part of a wave of US investment into European football. Ares Management, the US private equity firm with numerous investments in sport, provided the bulk of financing for the acquisition.

Olympique Lyonnais, commonly referred to as simply Lyon or OL, is a French professional football club based in Lyon in Auvergne-Rhône-Alpes (France). The men play in France’s highest football division, Ligue 1.

The Parc Olympique Lyonnais, known for sponsorship reasons as the Groupama Stadium, is a 59,186-seat stadium in Décines-Charpieu, in the Lyon Metropolis (France). The home of the French football club Olympique Lyonnais, it replaced their previous stadium, the 35,000-capacity Stade de Gerland, in January 2016.

The Eagle Football Holdings Limited is a family of global football organizations with top-tier clubs based in London (UK), Lyon (France), Brussels (Belgium), and Rio de Janeiro (Brazil). Eagle Football fosters a collaborative ecosystem of clubs with the main focus of maximizing competitive advantage through a global network of talent identification.

Los Angeles (US)-based the Ares Management Corporation is a leading global alternative investment manager offering clients complementary primary and secondary investment solutions across the credit, private equity, real estate, and infrastructure asset classes. It seeks to provide flexible capital to support businesses and create value for its stakeholders and within its communities.

‘FINANCIAL TIMES’ further stated that Textor, who previously said he wanted to pay off all Lyon’s debt not linked to its stadium within two years, informed that he was currently in the process of “paring off non-core assets to focus on football”, and that Lyon had been “way too heavy on physical assets”.

He added that the money generated from asset sales could be better used to invest in youth academies and player development, as well as reducing debt linked to the takeover.

The club has invited bids for either 40 percent or full control of the LDLC Arena, a new multipurpose venue due to be completed later this year. It is also exploring the sale of its US women’s team, OL Reign, which could fetch about $50mn based on the recent sale of a new team franchise in the same league.

The LDLC Arena is a new concert hall under construction in the heart of Lyon (France). This ERP building located to the East of the City can accommodate 16,000 people. Its roof is entirely covered with Phonotech DK140 acoustic panels. The LDLC Arena will be the largest indoor arena in France outside Paris and one of the most technologically and environmentally advanced in Europe.

‘basketnews.com’ stated that in a latest development, the ASVEL President Tony Parker has expressed interest in acquiring the LDLC Arena amidst Olympique Lyonnais’ financial crisis.

‘basketnews.com’ quoted Parker as stating, “I spoke about it with my shareholders. They want to go for it, and we want to position ourselves to buy the arena. I think we will be in a strong position. OL [Olympique Lyonnais] is still a shareholder in ASVEL, and for them, it would be beneficial if it returned to the group that I lead, remaining within the Lyon ecosystem.”

The ASVEL Basket, commonly known as ASVEL or sometimes as ASVEL Lyon-Villeurbanne, and also known as LDLC ASVEL for sponsorship reasons, is a French professional basketball team that is located in the City of Villeurbanne, which is a suburb of Lyon, France. They play at the 5,556-capacity Astroballe in Villeurbanne, France.

In May, Eagle sold a controlling stake in Lyon’s women’s team (Olympique Lyonnais Féminin) to the US businesswoman Michele Kang. That deal – for the most successful team in European women’s football – is still awaiting approval from the French authorities.

Textor has also hired Goldman Sachs (American multinational investment bank and financial services company) to raise about €300mn from the bond market as part of a broader effort to improve the club’s finances. The money raised would be secured against the club’s stadium and used in part to refinance the existing loans from about a dozen different banks, he said.

The Olympique Lyonnais Groupe had €321mn net debt at the end of 2022, according to its most recent financial statements, which showed a first half net loss of €60.7mn.

Lyon was once the dominant force in French football, winning seven consecutive titles between 2002 and 2008, but its form has slipped in recent years. The team finished seventh in the league table last year, while it no longer ranks in Deloitte’s (British multinational professional services network) top 30 richest clubs in European football.

A day after completing the takeover, Textor agreed to a provisional deal to combine Eagle Football with the Iconic Sports Acquisition Corporation, a blank check vehicle backed by the hedge fund billionaire Jamie Dinan and the former banker Alexander Knaster, according to SEC (U.S. Securities and Exchange Commission) filings. The agreement valued Eagle Football at $1.2bn, and would have been the first attempt to list a multiclub football vehicle.

London (UK)-based the Iconic Sports Acquisition Corporation is a newly incorporated special purpose acquisition company formed to establish a business combination with an iconic Global Sports Franchise or Sports Data, Media or Technology Company.

However, that plan has now been called off, Iconic announced recently. Iconic’s backers took a $75mn stake in Eagle Football as part of the original agreement, and now have the option of recalling their investment, as per reliable sources.

Instead, Textor hopes to list Lyon – which still has shares trading on Euronext (a pan-European bourse) – and his other football holdings in the United States early next year in what would effectively be an initial public offering (IPO). The Eagle Football also owns the Brazilian sports club Botafogo (Brazil), the Belgian professional football club RWD Molenbeek (Belgium) and a roughly 40 percent stake in the Premier League team Crystal Palace F.C. (UK).

A move to list Lyon in the United States would have echoes of Textor’s 2020 deal to merge Facebank, his facial recognition software business, with the sports streaming service FuboTV. Textor stepped down from the combined company six months later during a share price surge that gave Fubo a market capitalization of about $8bn at its peak. But the stock market value of the company has since fallen sharply to about $700mn.

Textor’s brief tenure as the Lyon owner has been turbulent both on and off the pitch. Under the original agreement, the former owner Jean-Michel Aulas was due to stay on and run the club for three years. However, Aulas, a towering figure in French football who had owned Lyon since 1987, was pushed out after just four months following a disagreement over strategy.

Since then, the relationship has become increasingly acrimonious. Aulas, who still holds an eight percent stake in Lyon through his company Holnest, began legal proceedings related to his departure that resulted in a court order freezing the club accounts containing €14.5mn in the month of August. In a statement, Lyon called the move an “attack” that was “as violent as it is illegitimate”.

Soon after Aulas’ departure, French football’s financial regulator rejected Lyon’s spending budget, a move that limited the club’s ability to sign new players this Summer.

Textor responded by selling some of Lyon’s most-sought-after players and used Eagle Football’s other clubs to help facilitate new arrivals. In a highly unusual move, Eagle-owned Molenbeek signed Ghanaian winger Ernest Nuamah for €25mn – a Belgian transfer record – and then agreed to loan him to Lyon the following day. The move is due to be made permanent next Summer.

Textor admitted that the first few months since he took charge had been “awkward” but that the club was on the right path – “You expect some turbulence. Nobody ever sold a club when everything was going well. But this is where you have the value opportunities.”

Yet, on the pitch Lyon’s fortunes have been floundering. The team has not won any of its opening six games of the season, making it the worst start in the club’s history. At the end of a recent home match, players were forced to stand in silence as the head of Lyon’s “ultras” fan group berated them publicly for their poor performances. Former French international Laurent Blanc was fired as the Head Coach soon after.

Textor said it was far too soon to judge his time at Lyon, and pointed to his other clubs, which have fared well under his direct control. Molenbeek was promoted to the first tier of Belgian football this Summer, while Botafogo is currently on the top of the league table just two years after returning to the Brazilian top flight.

He remains confident that the Eagle Football model, which he describes as scouting unknown talents, avoiding star players and selling those in demand for profit, will ultimately pay off in France.

He concluded by stating, “Give me a year and a half. Our approach has worked in other markets, we’ll see if it works in Lyon.”

Continue to follow Coliseum for latest updates on venues business news. Coliseum is dedicated towards building the best global community of sports and entertainment venue executives and professionals creating better and more profitable venues.

Become a member of the only Global Sports Venue Alliance and connect with stadiums, arenas and experts from around the world. Apply for membership at coliseum-online.com/alliance and make use of the 365Coliseum Business.

« Previous News: Canada Life Centre bring-alive F&B concessions

» Next News: BC Place inclusive experience for fans-guests

Related News

Kraken digital tech on Spurs sleeves

The Premier League team Tottenham Hotspur Football Club have secured a groundbreaking global... » Read more

Stadium of Light ‘light’ years ahead digi tech

The Championship team Sunderland A.F.C. is continuing to support fans following the introduction of... » Read more

Philippines majestic music venue plans

The officials of the Clark International Airport Corporation (CIAC) in Pampanga, Philippines, the... » Read more

Attendance record for German football

Fan attendances in the top two flights of German football hit a new record in the 2023-2024... » Read more

Pitch view rooms at new Edgbaston hotel

Edgbaston Stadium has picked Radisson as the venue’s hotel partner as more details of its... » Read more

Our News tags

- 'Espai Barca'

- ‘A’s’

- ‘Back to Live!’

- ‘Ball Arena’

- ‘Bud Light Beer Garden’

- ‘Field of Dreams’

- ‘Get in touch’-service

- ‘Go Safe’

- ‘Great Build’

- ‘Green’ energy

- ‘Green’ Olympics

- ‘My All’ Campaign

- ‘Pro Event’

- ‘Sbloccastadi’

- ‘sex doll’ incident

- ‘Share The Passion’

- ‘stadium’ competition

- ‘The Arena’

- ‘The Block’

- ‘The Cathedral’

- ‘The Krewe’s Nest’

- ‘The Sage’

- ‘The Sky Blues’

- ‘The Sunday Times’

- ‘The Swamp’

- ‘TRILOGY’

- (NFT)-ticketed

- #AlarmstufeRot

- $CITY

- 1. FC Cologne

- 1. FC Kaiserslautern

- 1. FC Köln

- 1. FC Nürnberg

- 1. FC Union Berlin

- 10 percent of its revenue

- 10.000.000th visitor

- 100 percent capacity

- 1000 people will be permitted

- 10th year anniversary

- 1300SMILES Stadium

- 17 games

- 1860 Munich

- 1rock Technology

- 2 meters distance

- 20 percent occupancy

- 20:20

- 20000-seat arena

- 2004 Athens

- 2019 Cricket World Cup

- 2020 Olympic and Paralympic Games

- 2020 Olympics

- 2020 Summer Olympics

- 2020-21 seasons

- 2021 Concacaf Gold Cup

- 2021 Copa América Final

- 2021 Phillips 66 Big 12 Men’s Basketball Championship

- 2021 Rugby World Cup

- 2021 season

- 2021 Women’s European Championship

- 2021 World Baseball Classic

- 2022

- 2022 Commonwealth Games

- 2022 FIFA World Cup™

- 2022 MLS All-Star Game

- 2022 Olympic

- 2022 Olympics

- 2022 Pro Bowl

- 2022 Qatar FIFA World Cup™

- 2022 regular season

- 2022 Shamrock Series

- 2022 Winter Olympics

- 2022 World Cup

- 2023

- 2023 AFC Asian Cup

- 2023 AFC Asian Cup™

- 2023 Asian Cup

- 2023 Caribbean Series

- 2023 Concacaf Gold Cup

- 2023 FIFA Beach Soccer World Cup™

- 2023 FIFA Women’s World Cup™

- 2023 Heineken Champions Cup

- 2023 Men’s Hockey World Cup

- 2023 NHL Global Series™

- 2023 Pacific Games

- 2023 Pan American Games

- 2023 Rugby World Cup

- 2023 Winter Classic

- 2023 World Athletics Championships

- 2024

- 2024 Concacaf W Gold Cup

- 2024 Coupe de France

- 2024 European Athletics Championships

- 2024 IIHF

- 2024 NFL Draft

- 2024 NHL Global Series™

- 2024 Olympics

- 2024 Summer Olympics

- 2024 Winter Classic

- 2024 Winter Youth Olympic Games

- 2024 Winter Youth Olympics

- 2024 World Para Athletics Championships

- 2025

- 2025 All-Star Game

- 2025 Asian Youth Games

- 2025 Club World Cup

- 2025 World Cup

- 2025 World Games

- 2026

- 2026 Commonwealth Games

- 2026 FIFA World Cup™

- 2026 Olympics

- 2026 Winter Olympics

- 2026 Winter Olympics and Paralympic Games

- 2026 World Cup

- 2026 World Cup Bid Committee

- 2026 World Cup final

- 2027

- 2027 AFC Asian Cup

- 2027 Africa Cup of Nations

- 2027 Asian Cup

- 2027 FIFA Women’s World Cup™

- 2027 FISU World University Games

- 2027 Pan American Games

- 2027 Rugby World Cup

- 2027 UEFA Europa League

- 2028

- 2028 European Championship

- 2028 Los Angeles Games

- 2028 Olympic and Paralympic

- 2028 Summer Olympics

- 2029 Asian Winter Games

- 2029 World Athletics Championships

- 2029 World Championships

- 2030

- 2030 Asian Games

- 2030 FIFA World Cup™

- 2030 Winter Olympics

- 2030 World Cup

- 2030 World Expo

- 2032

- 2032 Brisbane Games

- 2032 Olympic

- 2032 Olympic Games

- 2032 Olympics

- 2032 Summer Olympics

- 2034 FIFA World Cup

- 2034 FIFA World Cup™

- 2034 World Cup

- 2036 Olympic Games

- 2036 Summer Olympics

- 24/7 Software

- 24th FIFA World Cup™

- 25 percent

- 25 percent capacity

- 25th FIFA World Cup™

- 28 Black Arena

- 2G

- 3-D model

- 30 feet of the court

- 30 percent capacity

- 30-per-cent capacity

- 310 Provisions F&B

- 365Business Center

- 365Coliseum Business Center

- 3D Digital Venue

- 3D models

- 3D simulations

- 3D Venue

- 3XN

- 3XN Copenhagen

- 40 percent

- 49ers

- 49ers Enterprises

- 5+

- 50 percent

- 50 percent capacity

- 5000 fans

- 5G

- 5G network

- 5G Smart Venue

- 5G technology

- 76 Devcorp

- 76ers

- 777 Partners

- 777 Partners LLC

- 8K video replay system

- A-League

- A-League football

- A.C. Milan

- A.C. Pisa 1909

- A.F.C. Bournemouth

- A.G. Spanos

- A.S. Roma

- A.Z. Alkmaar

- AACIC

- Aalborg

- AAM

- AAMI Park

- AAP

- Aarau

- Aarhus

- Aaron Ling Johanson

- ABB

- ABB FIA Formula E

- ABBA Arena

- Abbey Stadium

- Abbott Road

- Abdoulaye Wade Stadium

- Abdulaziz bin Turki Al Saud

- Abdulla Al Habbai

- Abdullah Al Dawood

- Aberdeen

- Aberdeen F.C.

- Aberdeen FC

- Aberdeen Football Club

- Abertay University

- Abidjan

- Abloy

- Abloy Oy

- abseil down

- Abu Dhabi

- Abu Dhabi Cricket

- Abu Dhabi Cricket & Sports Hub

- Abu Dhabi Grand Prix

- Abu Dhabi HSBC Championship

- Abu Dhabi Motorsports

- Abu Dhabi Motorsports Management

- Abu Dhabi Sports Council

- Abu Dhabi United Group

- AC Milan

- AC Sparta Prague

- academy

- Academy Music Group

- Academy Stadium

- ACB

- ACC

- access control

- Access Educational Provision

- accessible

- accommodation

- Accor

- Accor Stadium

- ACE

- ACF Fiorentina

- ACF Florentina

- ACHA

- acquire

- acquired

- acquisition

- Acrisure

- Acrisure Arena

- Acrisure Stadium

- action sports

- Ad Diriyah

- AD Gaming

- Adam Goodyer

- Adam Horodecki

- Adam Silver

- Adam Wilkes

- Adams Park Stadium

- additional expenditure

- additional seating

- additional tickets

- Adela de la Torre

- Adelaide

- Adelaide Aquatic Centre

- Adelaide Crows

- Adelaide Football Club

- Adelaide Oval

- Adelaide Riverbank

- Adelaide United FC

- Adelaide United Football Club

- Adelaide United stadium

- ADG

- ADI

- Adidas

- Adille Sumariwalla

- Aditya Virwani

- ADMM

- ADO Den Haag

- Adobe

- Adrian Cefalan

- ADSC

- ADUG

- Advent International

- AdventHealth

- Adventist Health

- Adventist Health Arena

- advisory

- Adyen

- AEC

- AECOM

- AECOM Hunt

- AECOM Sports

- AEG

- AEG Europe

- AEG Facilities

- AEG Global

- AEG Ogden

- AEG Presents

- AEK Athens F.C.

- AEK Athens FC

- AELTC

- AEW

- AFA

- AFAS Stadion

- AFC

- AFC Ajax

- AFC Asian Cup

- AFC Asian Cup 2027

- AFC Asian Cup China 2023

- AFC Asian Cup™

- AFC Asian Qualifiers

- AFC Champions League

- AFC Champions League Elite

- AFC Cup

- AFC Stadium

- AFC Wimbledon

- AFC Women’s Champions League

- AFCON

- Afghanistan

- Afghanistan Cricket Board

- AFI

- AFL

- AFL Architects

- AFL Grand Final

- AFL Queensland

- Africa

- Africa Cup of Nations

- African

- African Cup of Nations

- African Football nations

- African football to the top of the world

- African Super League

- AFS Stadion

- Agencia APP Medellín

- Aghdam

- Agia Sophia Stadium

- agn Niederberghaus & Partner

- agreement

- agreements

- Agustín García Puga

- Agustín Pichot

- AHL

- AHL franchise

- Ahmad Bin Ali Stadium

- Ahmed Al Obaidly

- Ahmedabad

- AI

- AI platform

- AIG Women’s Open

- Aigars Kalvitis

- AIL

- Aintree Racecourse

- Air Albania Stadium

- Air Canada Centre

- Air Force Academy Athletic Corporation

- Air Force Academy Foundation

- air quality

- air-cleaning technology

- AirHogs Stadium

- airline

- Airport City

- AIS

- AIS Arena

- Ajax Amsterdam

- Akbar al-Baker

- Al Ahly

- Al Ahly SC

- Al Ain

- Al Awwal Park Stadium

- Al Barakah International Investment

- Al Bayt Stadium

- Al Dana Amphitheatre

- Al Dana Amphitheatre Bahrain

- Al Davis

- Al Guido

- Al Hilal

- Al Hilal SFC

- Al Hosn app

- Al Janoub

- Al Jazira Club

- Al Khor

- Al Nasr Club

- Al Qana

- Al Rayyan

- Al Rayyan Sports Club

- Al Rayyan Stadium

- Al Thumama Stadium

- Al Wasl Football Club

- Al-Arabi Club

- Al-Awwal Park

- Al-Awwal Park Stadium

- Al-Ettifaq FC

- Al-Hilal Club

- Al-Janoub Stadium

- Al-Nasr Sports Club

- Al-Nassr FC

- Al-Suqor Club

- Alabama

- Alan Burrows

- Alan Gilpin

- Alassane Ouattara Stadium

- Alastair Warwick

- Albania

- Albany

- Albawani

- Albert Speer + Partner

- Albert Speer + Partner GmbH

- Albert Speer+Partner

- Alberta

- Alberto Picco Stadium

- Albertsons Stadium

- Albuquerque

- alcohol

- alcohol license

- alcohol-free

- Aldar Properties

- Alderman Harrie van Dijk

- Alec Jackman

- Alejandro Dominguez

- Aleksander Ceferin

- Alessandro Antonello

- Alessandro Pasquarelli

- Àlex Barbany

- Alex Barbany Fernández

- Alex Bowen

- Alex Fischer

- Alex Leitão

- Alex Merchán

- Alex Shambrook

- Alex Wuerfel

- Alexander Casas

- Alexander Hardieck

- Alexander Stadium

- Alexander Wuerfel

- Alexandra Willis

- Alexandre Kalil

- Alexandria

- Alfred Technologies

- Algeria

- Algiers

- Algorand

- Ali Sami Yen Spor Kompleksi

- Alibaba

- Alibaba Cloud

- Alibaba Group

- Alibaba Sports

- Alicante

- Alipay

- Alisher Usmanov

- Alison Hughes

- Aljada

- ALK Capital

- Alkmaar

- ALL

- All Elite Wrestling

- All England Lawn Tennis and Croquet Club

- All England Lawn Tennis Club

- All England Lawn Tennis Ground

- all entities can sign in/sign up

- All India Football Federation

- All Net

- All Net Arena

- All-African Games

- All-Star

- All-Star 2024

- All-Star Game

- All-Star Week

- All-Star Weekend

- Allegiant Air

- Allegiant Stadium

- Allegiant Stadium in US

- Allegiant Stadium is a domed stadium under construction

- Allen Johnson

- alliance

- Allianz

- Allianz Arena

- Allianz Field

- Allianz Park

- Allianz Parque

- Allianz Riviera

- Allianz Stadium

- Allied Esports

- Allied Esports Entertainment

- Allison Howard

- allow crowds

- allow fans

- allow spectators

- allowed in the stadiums

- Allsvenskan

- Almadinah

- Almere City

- Aloha Stadium

- Aloha Stadium Authority

- Aloha Stadium Entertainment District

- Alper Afşin Özdemir

- Alpharetta Sports & Entertainment

- Alpine World Ski Championships to 2022

- Alps’ region

- altafiber

- Altair Arena

- Altay Alsancak Stadium

- alternative stadium

- AlUla

- Alva Skog

- Alvaro Mauricio Olarte

- Amaala

- Amahoro Stadium

- Amalie Arena

- Amazon

- Amazon Web Services

- AMB Sports & Entertainment

- AMB Sports and Entertainment

- AMBSE

- Ameet Bains

- Amerant Bank

- Amerant Bank Arena

- America First Credit Union

- American Airlines Arena

- American Collegiate Hockey Association

- American Cricket Enterprises

- American Express Community Stadium

- American Express Stadium

- American Family Field

- American football

- American Football Conference

- American Hockey League

- AmericanAirlines Arena

- Amex

- AMH Sports

- Amion Consulting

- Amir Cup

- Amir Cup final

- Ammar Hina

- Amnesty International

- Amnon Harman

- Amparo Roig

- ampm ASAP Grab and Go

- Amsterdam

- Amuka Esports

- Amway Center

- Amy Latimer

- Amy Trynka

- an average

- Anaheim

- Anaheim Arena Management

- Anaheim City Council

- Anaheim Ducks

- analysis

- ANC

- anchor tenant

- Andbox

- Anderlecht

- Anderson Training Center

- Andrea Butti

- Andrea Gaudenzi

- Andrea Patry

- Andreas Kapoulas

- Andrew Billingham

- Andrew Daniels

- Andrew Elmer

- Andrew Fagan

- Andrew Hill

- Andrew James

- Andrew Lustgarten

- Andrew M. Cuomo

- Andrew McIntyre

- Andrew Mobbs

- Andrew Pottinger

- Andrew Smith

- Andrew Whitham

- Andy Bush

- Andy Gorchov

- Andy Hughes

- Andy Lansing

- Andy Loughnane

- Andy Lustgarten

- Andy O’Sullivan

- Andy Rice

- Andy Simons

- Andy Wagner

- Anfield

- Anfield Road

- Anfield Road stand

- Anfield Stadium

- Angel City FC

- Angel Stadium

- Angela Ruggiero

- Angelo Binaghi

- Angelo Giannuzzi

- Angelo Giaunnuzzi

- Anheuser-Busch

- Aníbal Mosa

- Anil Murthy

- Animoca Brands

- Anita Siraki

- Ankura

- Anna König Jerlmyr

- Anna McKenzie

- Anne Sheehan

- anniversary

- Anniversary Games

- Annual Review

- Anoeta Stadium

- Anschutz Entertainment Group

- Antananarivo

- anthem singer

- Anthony Cole-Johnson

- Anthony James Partners

- Anthony Joshua

- Anthony Noto

- Anthony Perez

- Anthony Piqueras

- Anthony Precourt

- Anthony Ward

- Antigua and Barbuda

- Antonio Martins

- Anurag Jain

- ANZ Stadium

- AO

- AO Arena

- AO StartUps program

- AOK-Stadion

- ap

- Apex

- APOEL FC

- Apollodorus Architecture

- apology

- app

- Appetize

- Apple Pay

- appointment

- appointments

- approved

- APT SKIDATA

- AR

- Arab nations

- Arabian Gulf Cup

- Arada

- Aragon

- Aramark

- Aramark Sports + Entertainment

- Aramco

- architect

- Architect of Record

- architect Tarik Oualalou

- architects

- architectural competition

- architectural design elements

- architectural membranes

- architecture

- Arctos

- Arctos Sports Partners

- area in Cardiff

- Arechi Stadium

- arena

- Arena Alive S.L.

- Arena AufSchalke

- Arena Birmingham

- Arena Bogotá

- arena complex

- Arena Corinthians

- Arena da Amazônia

- Arena das Dunas

- Arena de València

- Arena Del Rio

- Arena Du CO’Met

- Arena Events Group

- Arena Football League

- Arena Garibaldi

- Arena Group

- Arena Hall

- Arena Kuwait

- Arena Livyi Bereh

- Arena MRV

- Arena of IoT

- arena project

- Arena Regensburg

- Arena Riga

- Arena Vila Belmiro

- Arena Wrocław

- Arena Zabrze

- arenas

- Ares Management Corporation

- Argentina

- Argentine Rugby Union

- Argentine Super Cup

- Argentinos Juniors

- Arizona

- Arizona Cardinals

- Arizona Coyotes

- Arizona Diamondbacks

- Arizona Rattlers

- Arizona State

- Arizona State University

- Arkansas Razorbacks

- ARL

- ARLC

- Arlington

- Arlington Heights

- Arlington International Racecourse

- Armand-Cesari Stadium

- Armen Dembekjian

- Armenia

- Army Black Knights

- Army West Point

- Army West Point Athletic Association

- Army-Navy

- Arn Tellem

- Arne Sebastian Fritz

- ARound

- Arquitectonica

- arrests

- Arrowhead

- Arrowhead Stadium

- Arry Wibowo

- Arsenal

- Arsenal F.C.

- Arsenal FC

- art gallery

- Arte Moreno

- Artemio Franchi Stadium

- artificial intelligence

- Aruba

- Aruba ESP

- Arup

- Arup Architects

- AS Monaco

- AS Monaco Basket-Ball S.A.

- AS Roma

- AS+P

- AS+P Albert Speer + Partner GmbH

- Asahi Lifestyle Beverages

- ASAP.com

- Ascent Drive Resort

- Ascot

- Ascot Racecourse

- Ascott

- Ashes

- Ashraf Sobhy

- Ashton Gate

- Ashton Gate Ltd.

- Ashton Gate Stadium

- Ashton Griffith

- Asia Cup

- Asian Beach Games

- Asian Cricket Council

- Asian Cup

- Asian Football Confederation

- Asian Football Cup

- Asian Games

- Asian Games 2030

- Asian Winter Games

- Ask: PATRIZIA

- Ask:PATRIZIA

- ASM

- ASM Global

- ASM Global Academy

- ASM Global APAC

- Asociación Argentina de Polo

- Aspire Zone

- Aspire Zone Foundation

- Asset One Immobilienentwicklungs-GmbH

- ASTAD Project Management

- Aston Villa

- Aston Villa F.C.

- Aston Villa FC

- Aston Villa Football Club

- Asymptote

- AT&T

- AT&T Byron Nelson

- AT&T Center

- AT&T Stadium

- Atalanta BC

- Atalanta Bergamasca Calcio

- Atalanta Bergamo

- Atanasio Girardot Sports Complex

- Atanasio Girardot Stadium

- Atatürk Olympic Stadium

- Atelier Mauch

- Ateliers 2/3/4

- Athens

- Athens Olympic Sports Centre

- Athens Olympic Sports Complex

- athletes’ village

- athletic

- Athletic Bilbao

- Athletic Club

- athletics

- athletics and healthcare facilities

- Athletics Federation of India

- athletics track

- ATJ Architekci

- Atlanta

- Atlanta Braves

- Atlanta Falcons

- Atlanta Hawks

- Atlanta United

- Atlantic City

- Atlantic Coast Conference

- Atlantic Wharf

- Atletico

- Atlético de Madrid

- Atletico Madrid

- Atlético Mineiro

- Atletico Mineiro

- Atlético River Plate

- atmosphere

- Atomic Data

- ATP

- ATP Finals in London

- ATP Tour

- attendance

- attendance cap

- attendance plans

- attendance record

- Attendance records

- attendances

- attending

- attractions

- Auburn Athletics

- Auburn University

- Auckland

- Auckland FC

- Auckland Stadiums

- auction

- Audi Field

- audience

- audiences

- audio content

- audiovisual

- AUF

- augmented reality

- Augmented safety measures

- Augusta

- Aura

- Aurelio de Laurentiis

- Austin

- Austin City

- Austin FC

- Austin FC Stadium

- Australia

- Australia Cup 2022 Final

- Australian

- Australian Football League

- Australian Grand Prix

- Australian Institute of Sport

- Australian National Rugby League

- Australian Olympic Committee

- Australian Open

- Australian Rugby League

- Australian Rugby League Commission

- Australian Rules

- Austria

- Austria Lustenau

- Austria Salzburg

- Austrian

- Austrian Football Association

- Austrian Football Bundesliga

- Austrian Grand Prix

- autistic

- Autodrome

- Autograph Stadium Sound

- AutoNation

- AVANGAR

- Avery Dennison

- Avicii Arena

- Avijit Yadav

- Avishek Dalmiya

- Aviva Stadium

- awarded

- AWPAA

- AWS

- AXA

- AXA Training Centre

- Axel Eichholtz

- Axel Hellmann

- Axis Leisure Management

- AZ Alkmaar

- Azerbaijan

- Azerbaijan Grand Prix

- Azerbaijian

- Aztec Stadium

- B.C. Place

- B&L Real Estate

- back into sporting events

- back to the stadia

- back to the stadium

- backburner

- Baghdad

- Bahrain

- Bahrain International Circuit

- Bahrain International Exhibition and Convention Centre

- Bain Capital

- Baku

- BAL

- Balaton Park Circuit

- Balazs Furjes

- Ball Aluminum Cup™

- Ball Corporation

- ballpark

- ballparks

- Bally’s Corporation

- Ballymore Stadium

- Baltimore

- Baltimore Arena

- Baltimore Development Corporation

- Baltimore Orioles

- Baltimore Ravens

- BAM

- BAM Construction

- BAM Deutschland

- BAM Deutschland AG

- BAM International

- BAM Sports

- BAM Sports GmbH

- Ban on major events

- Banc of California

- Banc of California Stadium

- Bangalore International Airport Limited

- Bangkok

- Bangladesh

- Bank of America Stadium

- Bank of Montreal

- Bank of the James Stadium

- Bankers Life Fieldhouse

- banknote

- bankrupt

- bankruptcy

- Bankwest Stadium

- banned

- Baptist Health

- Barbara Jordan

- Barça Hospitality

- Barceló Hotel Group

- Barcelona

- Barclaycard Arena

- Barclays

- Barclays Center

- Barea Stadium

- Bari

- Barnet F.C.

- Barnsley Football Club

- Barranquila

- Barranquilla

- Barrie Ho

- Barrow A.F.C.

- Barrs Court Contstruction

- Barry Bragg

- Barry Hearn

- Barsapara Stadium

- Barton Malow

- baseball

- Baseball Dream Park

- baseball league

- baseball park

- baseball stadium

- Basel

- Basel 1893

- Basketball

- Basketball Africa League

- Basketball Arena

- basketball championship

- basketball franchise

- basketball stadium

- BASMA Group

- Basra

- Basra International Stadium

- Bath

- Bath Football Club

- Bath Rugby

- Bathilde Lorenzetti

- Batumi

- Batumi Stadium

- Bavaria

- Bay Area

- BayArena

- BayCare Ballpark

- Bayer 04 Leverkusen

- Bayern Munich

- Bayfront Park

- Baylor University

- BBL

- BBVA Stadium

- BC Place

- BCCI

- BCEC

- BCW

- BDC

- BDP

- BDP Pattern

- beach soccer

- Bears

- Beaver Stadium

- Bechtel

- Beckham

- Becky Colwell

- Beemok Capital Group

- behind closed doors

- behind-the-scenes experience

- Beijing

- Beijing 2022

- Beijing 2022 Olympic Organizing Committee

- Beijing 2022 Organising Committee

- Beijing 2022 Winter Olympics

- Beijing Gehua CATV Network

- Beijing Guoan

- Beijing Urban Construction Group

- Belarus

- BELDEN

- Belfast

- Belgian

- Belgian Grand Prix

- Belgian Pro League

- Belgium

- Belgrade

- Belinda Majsdorovic

- Bell Bank

- Bell Centre

- Bell MTS Place

- Belmont Park

- Belo Horizonte

- Belong

- Belt and Road

- Ben Dolinky

- Ben Feferman

- Ben Gumpert

- Ben Hill Griffin Stadium

- Ben Hirschfeld

- Ben Kensell

- Ben Malin

- Ben van Berkel

- Bendac

- beneath

- BeNeLeague

- Benfica

- BENG Architectes

- Bengaluru

- Benito Villamarín Stadium

- Benoy Architect

- Benslimane

- Benteler-Arena

- Bentley Motors

- Bentley Record Room

- Bergamo

- Bergisel Ski Jump

- Berlin

- Bermuda

- Bern

- Bernabeu

- Bernd Freier

- Bernie Mullin

- Bescot Stadium

- BESIX

- best attended

- Bet365 Stadium

- Betfred Challenge Cup Final

- BetMGM

- betPawa

- betting

- betting lounge

- Betting Partner

- Betway

- beverage

- Beyer Blinder Belle

- Bhubaneswar

- BIAL

- Biathlon World Team Challenge

- Bid

- bidding process

- bidding rules

- Big 12

- Big 12 Conference

- Big Bash League

- Big Ten

- Big Ten Conference

- big-ticket events

- biggest cricket venue in the world

- biggest LED

- Bilbao

- Bill Bailey

- Bill Beaumont

- Bill Bullen

- Bill Foley

- Bill Haslam

- Bill Sweeney

- Billie Jean King National Tennis Center

- Bills

- Bills Stadium

- Billy Joel

- BIM

- bio-bubble

- BioCloud

- biometric

- biometric solutions

- Bird’s Nest

- Birmingham

- Birmingham 2022

- Birmingham City

- Birmingham City FC

- Birmingham City Football Club

- Bishkek

- Bishop Gunn

- bitcoin payments

- Bjarke Ingels Group

- Black Fire Innovation

- Black Ridge Acquisition Corp

- Blake High School

- BLAST

- Blau-Weiß Linz

- block chain

- blockchain

- blockchain technology

- Blockparty

- Blooming Arena

- BLT Architects

- Blue Horseshoe Ventures Ltd

- BlueCo

- Bluenergy Stadium

- BMI

- BMO

- BMO Centre

- BMO Field

- BMO Harris Bank Center

- BMO Stadium

- BMW

- BMW Park

- BMW Stadium

- BNP Paribas Open

- Board of Control for Cricket

- Board of Control for Cricket in India

- Bob Arum

- Bob Newman

- Bob Ward

- Bobby D’Angelo

- Bobby Dodd Stadium

- Bobcat Stadium

- Boca Juniors

- Bochum

- Bodelle Francis

- Bodour Al Meer

- Bodrum Arena

- Boeing

- Bogotá

- Bohemian FC

- Boise State Athletics

- Boise State University

- Bokaro Steel Plant

- Boldyn Networks

- Bolivia

- Bolivian

- Bolivian Football Federation

- Bollenfalltor

- Bologna

- Bologna Football Club 1909

- Bolton

- Bolton Stadium

- Bolton Wanderers

- Bolton Wanderers Football Club

- Bolton Whites Hotel

- Bomeran Diego Armando Maradona

- Bonus Arena

- Book Your Stadium

- Booking.com

- boost revenue

- Borg Al Arab Sports Hall

- Boris Becker

- Boris Becker International Tennis Academy

- Borussia Dortmund

- Borussia Moenchengladbach

- Borussia Mönchengladbach

- Borussia Park

- Bosch Rexroth

- Bossard Arena

- Boston

- Boston Bruins

- Boston Celtics

- Boston Planning & Development Agency

- Boston Red Sox

- Boston Unity Soccer Partners

- Botafogo

- Bournemouth

- Bouygues

- Bovingdons

- bowl

- boxing

- Boxing Day

- Boxing Day Cricket Test

- boxing matches

- Boylan

- Bozsik Stadium

- Brabourne Stadium

- Brad Estes

- Brad Jones

- Brad Mayne

- Brad Sims

- Bradford

- Bradford Bulls

- Bradford City AFC

- Brady Spencer

- Braga

- Brainport

- Bramley-Moore Dock

- Bramley-Moore Dock Stadium

- Brand

- brand identity

- brand new

- branded

- Brasileirão

- Brașov

- Braves

- Bravo Live

- Brazil

- Brazilian

- Brazilian Football Confederation

- Breckenridge Bourbon Club

- Breda

- BREEAM

- Bremen

- Bremer Brücke

- Brendan McGlinchey

- Brennan Wilkins

- Brent Cross Town

- Brent Kocher

- Brentford

- Brentford Community Stadium

- Brentford F.C.

- Brentford FC

- Brest

- Brett M. Johnson

- Brett Paulsen

- Brett Yormark

- Brew City Battle

- Breyer Group

- Brian Bilello

- Brian Celler

- Brian Kabatznick

- Brian Regan

- Brick Community Stadium

- Bridgeport

- Bridgeport Islanders

- Bridgestone Arena

- Brigham Young University

- Brighton

- Brighton & Hove Albion F.C.

- Brighton & Hove Albion Football Club

- Brighton and Hove

- Brighton and Hove Albion

- Brighton and Hove in England

- Brighton Homes Arena

- Brint Jackson

- Brisbane

- Brisbane 2032

- Brisbane Convention & Exhibition Centre

- Brisbane Cricket Ground

- Brisbane Entertainment Centre

- Brisbane Lions

- Brisbane Live arena

- Brisbane Tigers

- Bristol

- Bristol Bears

- Bristol Beer Factory

- Bristol City

- Bristol City Council

- Bristol City F.C.

- Bristol Dirt Nationals

- Bristol Flyers

- Bristol International Raceway

- Bristol Motor Speedway

- Bristol Raceway

- Bristol Rovers

- Bristol Rovers F.C.

- Bristol Sport

- Bristol Sports

- Bristol Street Motors

- British

- British and Irish Lions

- British Columbia

- British Esports Association

- British Grand Prix

- British Overseas Territory

- British Standards Institution

- British summer of sport is back on

- Brno

- broadcast

- broadcast strategy

- broadcasters

- broadcasting rights

- Broadway

- Broadway Theatre

- broke ground

- Bromley Council

- BroncoLIFE

- Broncos

- Broncos Plus

- Bronx

- Brookfield Housing

- Brookfield Property Partners

- Brooklyn Nets

- Brooks Boyer

- Browne Park

- Broxel

- Bruce Arena

- Bruce Caldwell

- Bruges

- Bruin Capital

- Bruin Sports Capital

- Bruno Cullen

- Brussels

- Bryan Reksten

- Bryant-Denny Stadium

- BSC Young Boys

- BSE Global

- BT

- BT Murrayfield

- BT Sport

- bubble

- BUCG

- Bucharest

- Buckeye

- Buckingham Group

- Buckingham Group Contracting

- Buckingham Group Contracting Limited

- Bud Light

- Budapest

- Buddy Dyer

- budget

- Budweiser Brewing Group

- Buenos Aires

- Buenos Aires Arena

- Buffalo

- Buffalo Bills

- Buffalo Sabres

- building

- Building Information Modelling

- Bujnowski Architekci

- Bulgaria

- Bulgarian

- Bulgarian Army Stadium

- Bullfighting

- Bundesliga

- Burnaby

- Burnham Park Project

- Burnley F.C.

- Burnley Football Club

- Burns & McDonnell

- Buro Happold

- BuroHappold

- Burson Cohn & Wolfe

- Burton Albion

- Bury F.C.

- Bury Football Club

- Busan

- Busch Light Clash

- Busch Stadium

- BusForFun

- Bushey Hall Golf Club

- business case

- Business Club

- business intelligence

- business suite

- Butchertown

- Butler University

- BVB

- bwin

- BYJU

- Bystrzyca Valley

- C.A. Osasuna

- C.F. Møller Architects

- C3

- CAA

- CAA ICON

- CAA Sports

- CAB

- cable roofs

- CAD

- Cádiz

- Cádiz CF

- Cádiz Club de Fútbol

- Caesars

- Caesars Arena

- Caesars Entertainment

- Caesars Entertainment Corporation

- Caesars Sportsbook

- Caesars Superdome

- CAF

- CAF Super Cup 2023

- Cagliari

- Cagliari Calcio

- Cairo

- Cairo Stadium

- Caixa Capital Risc

- Caledonia Gladiators

- calendar

- Calgary

- Calgary Event Centre

- Calgary Flames

- Caliente Stadium

- California

- California Golden Bears

- California Memorial Stadium

- called off

- CallisonRTKL

- Cambodia

- Cambridge

- Cambridge United

- Cambridge United F.C.

- Cambridge United Football Club

- Cambuur Stadium

- CAMC Engineering

- Camden Yards

- Cameroon

- Camp Nou

- campaign

- Campbelltown Stadium

- Campeonato Brasileiro

- Campeonato Brasileiro Série A

- Campeones Cup

- Camping World Stadium

- Camping World Truck Series

- Campo Argentino de Polo

- Canada

- Canada Life Centre

- Canadian

- Canadian division

- Canadian Grand Prix

- Canadian Premier League

- Canberra

- cancel

- cancel the deal

- canceled

- canceled events

- cancelled

- cancelling

- Cancún

- Candidate

- Candidate Cities

- Candy Fuzesy

- cannabidiol

- Canning

- Cannonballs

- canopy collapsed

- Cantaloupe

- Canterbury Bulldogs

- Cantù

- capacity

- capacity limits

- Cape Town

- Cape Town International Convention Centre

- Cape Town Stadium

- Capital

- Capital Football

- capital investment

- Capital One Arena

- Capital One Field

- CAQ

- car park

- Carabao Cup

- Carabao Cup final

- Caracas

- carbon footprint

- Carbon Footprint Calculator

- carbon neutral

- carbon neutrality

- carbon-neutral

- carbon-neutral arena

- Cardenas Marketing Network

- Cardiff

- Cardiff Bay

- Cardiff City F.C.

- Cardiff Stadium

- Cardinal Stadium

- Caribbean

- Carl A. Thomas

- Carl H. Lindner III

- Carl Hirsh

- Carlisle United

- Carlo Castellani Computer Gross

- Carlos de La Barrera

- Carlos Salvador Bilardo

- Carlos Suárez

- Carlton

- Carlton Arena

- Carolina Hurricanes

- Carolina Panthers

- Caroline Proulx

- Carolyn Goodman

- Carolyn Kindle

- Carrara Stadium

- Carrie Lam

- Carrow Road

- Cars Jeans Stadion

- Carson

- Carsten Cramer

- Carter-Finley Stadium

- Cartuja Stadium

- Casablanca

- Casal España Arena de València

- Casement Park

- Casement Park Stadium

- cash crunch

- cash injection

- cash-free

- cashless

- cashless payment solutions

- cashless services

- Castex

- Castleford

- Castleford Tigers

- Castore

- Catalonia

- caterer

- catering

- catering partner

- Caulfield Racecourse

- Cavs

- Cazalys Stadium

- CBD

- CBF

- CBRE

- CBS Arena

- Cbus Super Stadium

- CCFED

- CD Eldense

- Cedar Point Sports Center

- Cegeka

- celebrate

- Celta de Vigo

- Celtic Park

- censor signs

- Centenario

- Centene Stadium

- center

- center of activity

- Centerbrook Architects & Planners

- Centerplate

- Central Coast Council

- Central Coast Stadium

- Central Florida Fairgrounds

- Central League

- Centralni Stadion FK TSC

- CenturyLink Field

- CEO

- Cercle Brugge

- Ceres Park & Arena

- certified

- César O. Esparza

- Cessna Stadium

- CFA

- CFBPlayoff

- CFG

- CFG Bank

- CFG Bank Arena

- CFP

- CFP National Championship Game

- Chad Johnson

- Chad Morris

- Chain

- Chaix & Morel

- Challenge Cup

- Challenge Cup Finals

- challenges

- Champions and Challenge Cup

- Champions Cup

- Champions Hockey League

- Champions League

- Champions League Final

- Champions League Finals

- Champions Tour

- Champions Trophy

- Championship

- Chandigarh

- change

- change their name

- Changwon NC Park

- chargeFUZE

- Chargers

- Chargers Way

- Charging Provider

- charity fund

- Charlene Nyantekyi

- Charles H. (Chuck) Steedman

- Charlie Millerwise

- Charlie Talbot

- Charlotte

- Charlotte Athletics

- Charlotte Football Club

- Charlotte Hornets

- Charlotte Jones

- Charlton Athletic

- Charlton Athletic F.C.

- Chase Carey

- Chase Center

- Chase Field

- Chase Stadium

- Chatloop

- checkout-free concessions

- checkout-free technology

- Cheez It Bowl

- Chelsea

- Chelsea Creates

- Chelsea F.C.

- Chelsea Football Club

- Chelsea Foundation

- Cheltenham Festival

- Cheltenham Racecourse

- Chengdu

- Chengdu Sports Regulations

- CHEQ

- Chesapeake Energy Arena

- Chesapeake Energy Corporation

- Chester Race Company Limited

- Chester Racecourse

- Chesterfield

- Chesterfield FC

- Chesterfield Football Club

- Chicago

- Chicago Bears

- Chicago Blackhawks

- Chicago Bulls

- Chicago Cubs

- Chicago Fire

- Chicago Fire FC

- Chicago United Center

- Chicago White Sox

- Chichibunomiya Rugby Stadium

- Chicken N Pickle

- Chief Executive

- Chief Information Officer

- Chief Innovation

- Chief Marketing Officer

- Chief Operating Officer

- Chief Sustainability Officer

- Chief Technology Officer

- Chievo Verona

- child-friendly

- Children’s Mercy Park

- Chile

- Chilean

- Chilean Primera División

- China

- China League Two

- China Media Capital

- China Mobile Migu

- China Railway Construction

- China Sports Futurity Investment

- China to host more F1 races in the future

- China-funded

- Chinese

- Chinese Athletics Association

- Chinese Basketball Association

- Chinese Football Association

- Chinese Government

- Chinese Grand Prix

- Chinese investment

- Chinese National Winter Games

- Chinese Olympic Committee

- Chinese Super League

- Chiyoda Ward

- CHL

- Choctaw Stadium

- Chongqing

- Chris Albright

- Chris Allphin

- Chris Bray

- Chris Del Conte

- Chris DeVolder

- Chris Granger

- Chris Ilitch

- Chris Kermode

- Chris Kinimaka

- Chris McGowan

- Chris Roberts

- Chris Townsend

- Chris Whitney

- Chris Wright

- Christchurch

- Christchurch City Council

- Christian Fuchs

- Christian Jauk

- Christian Lau

- Christian Purslow

- Christian Schicker

- Christian Seifert

- Christine Strobl

- Christopher Halpin

- Christopher Ilitch

- Christopher Lee

- Christopher Sotiropulos

- Chukkers

- Chungcheong

- Churchill Downs

- Churchill Downs Racetrack

- Chybik + Kristof Architects & Urban Designers

- CIAC

- Cícero de Souza Marques

- Cidade Sporting

- CIMC

- Cincinnati

- Cincinnati Bengals

- Cincinnati Masters

- Cincinnati Open

- Cinven

- circuit

- Circuit de Barcelona-Catalunya

- Circuit de Spa-Francorchamps

- Circuit of Spa-Francorchamps

- Circuit of the Americas

- Cisco

- Citi Field

- CITIC Capital

- Citizens Bank Park

- Citrus Bowl

- City Football Academy

- City Football Group

- City Ground

- City of Fishers

- City of Goodyear

- City of Liverpool FC

- City of Roswell

- City of St. Petersburg

- city quarter

- CITYPARK

- Civic Arena

- Civic Auditorium

- Civitas Metropolitano

- CJ Live Arena

- Clair Global Brand Group

- Clare LePan

- Clark Construction

- Clark County

- Claude Atcher

- Claude-Patrick Jeutter

- Clay Campbell

- Clay Luter

- clean

- Clean Slate

- CleanEvent Services

- cleaning

- cleaning protocols

- CLEAR

- Clermont

- Cleveland

- Cleveland Avenue

- Cleveland Browns

- Cleveland Cavaliers

- Cleveland City Council

- Cleveland Guardians

- Cleveland Indians

- Cliff Cummings

- Climate

- climate change

- Climate Pledge Arena

- Clippers

- Cllr Andrew Western

- Cllr Martin Gannon

- close

- close the stand

- closed door

- Closed door cricket

- closed door event

- closed doors

- closing ceremony

- closing its borders

- closure

- cloud platform

- cloud software

- Clover Club

- Club América

- Club and Lounge

- Club Atlético de Madrid

- Club Atlético Osasuna

- Club Atlético Platense

- Club Atlético River Plate

- Club Atlético Unión

- Club Blooming

- Club Bolívar

- Club Bruges

- Club Brugge

- club concept

- Club de Metz

- Club Deportivo Universidad Católica

- Club Guaraní

- Club León

- club museum

- Club Nacional de Football

- Club SI

- club space

- Club Sport Emelec

- Club Sport Herediano

- Club Wembley

- Club World Cup

- Clube Atlético Mineiro

- Clymb

- CMN

- CMU

- CNG Stadium

- CNI

- Co-op

- Co-op Live

- Co-op Live Arena

- Coachella

- Coachella Valley

- Coachella Valley Arena

- Coalition Avenir Québec

- Coca-Cola

- Coca-Cola Arena

- Coca-Cola Music Hall

- Coffs Harbour

- Coke Studio

- Coldwell Banker Richard Ellis

- Coleman Coliseum

- Colin Chong

- Colin Mansbridge

- Colin Smith

- Coliseo de Puerto Rico José Miguel Agrelot

- Coliseum

- Coliseum – Global Sports Venue Alliance

- Coliseum @ Coliseum

- Coliseum Alfonso Pérez

- Coliseum Europe

- Coliseum Global Sports Venue Alliance

- Coliseum Online Week EUROPE

- Coliseum Online Week LATAM

- Coliseum Online Week MENA

- Coliseum Online Week US

- Coliseum Online Week US Worldwide

- Coliseum Summit

- Coliseum Summit EUROPE

- Coliseum Summit MENA

- Coliseum Summit MENA 2022

- Coliseum Summit US

- Coliseum Summits

- Coliseum US

- collaboration

- collapsed

- College

- college football

- College Football Playoff

- college football stadiums

- College of William & Mary

- colleges

- collegiate

- collegiate football bowl game

- Colliers

- Colo-Colo

- Cologne

- Colombia

- Colorado

- Colorado Avalanche

- Colorado Rockies

- Colorado Springs Switchbacks FC

- Colosseum

- Columbia

- Columbus

- Columbus Blue Jackets

- Columbus Crew

- Columbus Crew SC

- Columbus Crew Soccer Club

- Columbus Crew Stadium

- Comcast

- Comcast Spectacor

- Comcast Spectator

- comedy

- comedy festival

- Comerica Park

- Comic Con

- Commanders

- Commanders Field

- CommBank

- CommBank Stadium

- commerce platform

- commercial

- commercial development

- commercial partnership

- commercial revenue

- commercial strategy

- commercialization

- Commerzbank

- Commerzbank Arena

- Commissioner

- Commonwealth Games

- Commonwealth Games venues

- Commonwealth Stadium

- community

- community access

- Community Shield

- Community Sports Foundation

- Community Stadium

- Companeer

- Companeer GmbH

- Compania Nationala de Investitii

- Compass Group

- Compass Group UK

- compensate

- competition

- complaining

- completion

- complex

- Concacaf

- Concacaf Gold Cup

- Concacaf Nations League

- conceptual designs

- concerns

- concert

- concert crews

- concert venue

- concession contract

- concession stand

- concourse

- Confederation of African Football

- conference and exhibition center

- Conference Center

- conference program

- Confirmed360

- Confluence Village

- congressional

- CONMEBOL

- Connacht Rugby

- Connacht Rugby Stadium

- Connect Conference Centre

- Connecticut

- connectivity

- Connexin Live

- ConneXion Partnerships

- Conni Jonsson

- Constanța

- Construcciones Saddemi SA

- Construction

- construction company

- Construction Manager

- construction work

- consultancy

- consultation

- consulting

- continuing

- contract

- contractor

- contractors

- contracts

- contributed

- controversy

- Cooley Law School Stadium

- Coolidge Cricket Ground

- Coop Himmelb(l)au

- cooperation

- Coopers Stadium

- Copa America

- Copa América 2024

- Copa del Rey

- Copa Libertadores

- Copa Libertadores Final

- Copa Sudamericana

- Copper Box Arena

- Copthall Stadium

- Cordish

- Corinthians

- Coritiba Foot Ball Club

- Cork GAA

- CorkIreland

- Cornaredo Stadium

- Cornish Pirates

- Cornwall

- coronavirus

- coronavirus crisis

- coronavirus outbreak

- coronavirus pandemic

- coronavirus test sites

- coronavirus vaccination

- Corregidora Stadium

- Corruption

- Cortina

- Cortina 2021

- Cortina d’Ampezzo

- Cosm

- cost

- cost increase

- cost-cutting

- Costa Rica

- Costim Group

- costs

- COTA

- Cote d’Ivoire

- Cotton Bowl

- Cotton Bowl Stadium

- Council of Mallorca

- Counsilman-Hunsaker

- Country Music

- Country Music Awards

- Court

- court battle

- Courtside Bar

- Couto Pereira Stadium

- Coventry

- Coventry Arena

- Coventry Building Society Arena

- Coventry City

- Coventry City F.C.

- COVID

- COVID passes

- COVID Safe guidelines

- COVID-19

- COVID-19 Assistant

- COVID-19 Detection Dogs

- COVID-19 fan safety hub

- COVID-19 outbreak

- COVID-19 pandemic

- COVID-19 protocols

- COVID-19 testing

- COVID-Safe Guidelines

- Cox Architecture

- Cox Business

- Coyotes

- CPI Property Group

- CPKC Stadium

- CPL

- CPLT20

- CR Vasco da Gama’s Complexo

- Craig Hassall

- Craig McMaster

- Craig Thompson

- Craig Tiley

- crane

- Craven Cottage

- Craven Park

- Craven Park Campus

- Crawford Architects

- Creative Artists Agency

- Creative Artists Agency LLC

- Crew SC

- Crew Stadium

- cricket

- Cricket Association of Bengal

- Cricket Australia

- cricket format

- Cricket South Africa

- cricket stadium

- cricket venue

- Croatia

- Croke Park

- crowd

- crowd management

- crowd movements

- crowd noise

- crowd-science

- crowdfunding

- crowds

- Crucible Theatre

- Cruz Azul

- Cruzados

- crying foul

- crypto payments

- Crypto.com

- Crypto.com Arena

- cryptocurrency

- Crystal Palace

- Crystal Palace Academy

- Crystal Palace F.C.

- Crystal Palace Football Club

- CSA

- CSD

- CSEC

- CSFI

- CSKA Sofia

- CSL

- CSL Behring

- CSM

- CTI

- CTS Eventim

- CULD

- cultural and sports institutions

- Cultural Tourism Planning & Design Institute

- CUP-Capgirem

- Cure Bowl

- Curt Otaguro

- Cusack Stand

- customer service

- cut costs

- CVC

- CVC Capital Partners

- CWG

- cyber security

- Cybersecurity Partner

- Cyprus

- Czech

- Czech Football Association

- Czech Republic

- D. SPORTS

- D.C. United

- D.LIVE

- D.SPORTS

- d&b audiotechnik

- d&b Fanblock

- Dacia

- Dacia Arena

- Dadi Einarsson

- Daktronics

- Dale Vince

- Dalet

- Dalian

- Dalian Architectural Research and Design Institute

- Dalian Pro FC

- Dalian Yifang FC

- Dalian Youngboy F.C.

- Dalkia

- Dallas

- Dallas Cowboys

- Dallas Mavericks

- Dallas Renegades

- Dallas Wings

- Dalymount Park

- Dalymount Park Redevelopment Project

- Damian Willoughby

- Damian Woodward

- Dammam

- Dammam Sports City

- Dammam Stadium

- Dan August

- Dan Beckerman

- Dan Flynn

- Dan Friedkin

- Dan Gilbert

- Dan Harris

- Dan Levy

- Dan Lowe

- Dan Meis

- Dan Palmer

- Dan Smith

- Dan Williams

- Daniel Carciug

- Daniel Gidney

- Daniel Haddad

- Daniel Levy

- Daniel Libeskind

- Daniel Nolte

- Daniel Rodriguez

- Daniel Snyder

- Daniel Williams

- Danielle Argent

- Danika Wong

- Danish

- Danish Football Association

- Danish Football Union

- Danny Branch

- Danny Macklin

- Danny Sillman

- Danny Townsend

- Danny Wilson

- Danny Wimmer

- Danske Bank Premiership

- Danuta Dmowska-Andrzejuk

- DAP Group

- Daplast

- Dare Skywalk

- Darius and Girėnas Stadium

- Darmstadt

- Darmstadt 1898 e.V.

- Darmstadt 98

- Darragh MacAnthony

- Darren Burden

- Darren Eales

- Darren Moore

- Darryl Dunn

- Darryl Jeffrey

- Darwin

- Daryl Kerry

- Daryl Wolfe

- data

- Data#3

- Datuk Nalgunalingam

- Daugavas Stadium

- Dave Beachnau

- Dave Fowler

- Dave Kaval

- Dave McGeachan

- David Beckham

- David Booth Kansas Memorial Stadium

- David Chipperfield

- David Garth

- David Gianotten

- David Hines

- David Hodgkiss

- David Ige

- David Jones

- David Keirle

- David Kennedy

- David Levy

- David M. Campbell

- David McKillips

- David Mellen

- David Sánchez

- David Shaw

- David Stevenson

- David Tepper

- Davis Cup

- Davis Cup Finals

- Davis Wade Stadium

- Daybreak Field

- Dayton Convention Center

- Daytona 500

- Daytona Beach

- Daytona International Speedway

- DAYTONA Soccer Fest

- DAZN

- DBU

- DC Thomson Media

- DC United

- DCC

- DCT Abu Dhabi

- De Braak Campus

- De Kuip

- De Nieuwe Ploeg

- deadline

- deadline extension

- deal fell through

- Dean Trantalis

- debarred

- Decathlon Arena

- decline

- Dee Haslam

- Deep Dive Dubai

- Deepdale Stadium

- Deepraj Sandhar

- Deezer

- DEL 2

- Delaware County

- Delaware North

- Delaware Stadium

- delay

- delayed

- delays

- Delhi Capitals

- Delhi Development Authority

- Deloitte

- Delta

- Delta Air Lines

- Deltatre

- dementia-friendly

- Demium

- demolished

- Demolition work

- Den Haag Stadium

- DeNA BayStars

- Denis Le Saint

- Denise Barrett-Baxendale

- Denmark

- Denso Spark Plugs National Hot Rod Association

- Dentsu Inc

- Denver

- Denver Broncos

- Denver Nuggets

- Department of Culture and Tourism

- Deportivo Colo-Colo

- Deportivo de La Coruña

- Deportivo La Coruña

- Deportivo Universidad Católica

- Derby

- Derby City

- Derbyshire County Cricket Club

- Derek Schiller

- Derrick Hill

- Derry City

- Derry City Football Club

- Derwent Entertainment Centre

- Des Moines

- Desert Diamond

- Desert Diamond Arena

- Desert Financial Arena

- design

- design and build

- design competition

- Design Consultant

- design of esports venues

- Designs

- Desiree Reed-Francois

- Destination

- destroyed

- Detroit

- Detroit City FC

- Detroit Lions

- Detroit Pistons

- Detroit Red Wings

- Detroit Tigers

- Deutsche Bank

- Deutsche Bank Park

- Deutsche Eishockey Liga 2

- Deutsche Fußball Liga

- Deutsche Fußball Liga GmbH

- Deutsche Telekom

- develop

- developer

- Developers

- developing

- development

- development project

- Developmental Testing and Evaluation Designation

- Deventer

- Dexcom Inc.

- DFB

- DFB-Pokal

- DFL

- DHB

- Dhillon’s Brewery

- DHL

- DHL Express

- DHL Stadium

- DHL Stadium

- DHL Stormers

- DHS

- Diablos Rojos del Mexico

- Diageo

- Diamniadio

- Diamond Baseball Holdings

- Diamond League

- Dibba Sports Club Stadium

- Dick Cass

- Dick’s Sporting Goods Park

- Dickies Arena

- Dicky Evans

- Didier Quillot

- died

- Diego Armando Maradona Stadium

- Diego Maradona

- DIEZ

- different purposes

- digital

- Digital Arena

- digital customer experience

- digital ecosystem

- digital experiences

- digital fan engagement

- digital media networks

- digital payments

- digital platform

- digital platforms

- digital property rights

- digital service

- digital services

- digital services provider

- Digital Signage

- digital subsidiary

- digital ticketing

- digital tickets

- digital transformation

- DigitalBits

- Digitalization

- Digitalize Yourself

- Dignity Health Sports Park

- Dime Community Bank

- Dinamo

- Dinamo Bucharest

- Dinamo Stadium

- Dinamo Zagreb

- Ding Jianming

- Director in Venue Consultancy

- Director of Marketing

- Director of Ticket Sales

- Diriyah

- Diriyah Company

- disabled fans

- discontinue

- discovering the main challenges

- disease

- disinfecting

- disinfection

- Disney

- Disney On Ice

- Disney World

- display centerhung

- distance

- distancing

- district

- District Cricket Association

- District E

- diversity program

- DLA+

- DLA+ Architecture & Interior Design

- DLR Group

- Dmitry Azarov

- Dmitry Chernyshenko

- DMK

- DMPED

- DNCG

- Docklands Stadium

- Dodger Stadium

- Dogs

- Doha

- Doha Golf Club

- Dolphin Stadium

- Domain

- domed baseball stadium

- Dominic McKay

- Dominic Perrottet

- Don Garber

- Don Logan

- Don Webb

- Donald R Grebien

- Donald Trump

- donations

- Donauparkstadion

- Doncaster Rovers

- Donna Daniels

- Donovan Dela Cruz

- Dontá Wilson

- DoorDash

- Dorian Gorr

- Dorna Sports

- Dortmund

- DOSB

- double capacity

- doubt

- Douéra Stadium

- Doug Gaul

- Doug Hall

- Dover Motorsports

- DOW

- Downtown Jacksonville

- Downtown Kansas City

- Downtown Lansing’s Stadium District

- Downtown Spokane Partnership

- DP World

- DPP

- Dr Hassan Moustafa Sports Hall

- Dr Markus Schütz

- Dr. Adrian Cheng Chi-kong

- Dr. Debbie Kristiansen

- Dr. Debbie Stanford-Kristiansen

- Dr. Kiki Kaplanidou

- Dr. Peter H. Edwards Jr.

- Dr.-Ing. Christopher Kämereit

- Dragon Ball

- Drake & Scull International

- Dreisamstadion

- Dresden

- Dresdner SC

- drinking alcohol

- Drinks

- drive-in theater

- Drogheda United FC

- drone incursions

- drones

- drop of 40 percent

- Druzhkovka

- DRV PNK Stadium

- DSP

- DTCM

- du Arena

- Dubai

- Dubai 7s

- Dubai Arena

- Dubai Autodrome

- Dubai Basketball

- Dubai International Cricket Stadium

- Dubai International Stadium

- Dubai Opera

- Dubai Parks and Resorts

- Dubai Silicon Oasis

- Dubai Sports City

- Dubai Sports Council

- Dubai Super Cup

- Dubai World Cup

- Dubailand

- Dublin

- Dude Perfect

- Dude Perfect headquarters

- Dundalk

- Dundee

- Dundee & Angus College

- Dundee Arena

- Dundee City Council

- Dundee F.C.

- Dundee FC

- Dundee Football Club

- Dundee United

- Dundee United F.C.

- Dunedin

- Duquesne University

- Durham County Cricket Club

- Düsseldorf

- Dusseldorf

- Dustin R. Womble Football Center

- Dutch

- Dutch Eredivisie

- Dutch football

- Dutch Government

- Dutch Grand Prix

- DVTK Stadion

- DW Stadium

- Dwarka

- DY Patil Sports Stadium

- Dynamic Pricing Partners

- Dynamo Berlin

- Dynamo Dresden

- Dynasty Equity

- E Stanley Kroenke

- E-commerce

- E-Gap

- E-Prix

- e-sports organization

- e-tickets

- E. Stanley Kroenke

- EA SPORTS FIFA 20

- Eagles Community Arena

- earthquake

- EAS Betriebsgesellschaft mbH

- East Fremantle

- East Fremantle Oval

- East-West Shrine Bowl™

- Easter Road

- Eastside stadium

- Ebbsfleet United

- Ebbsfleet United Football Club

- ECB

- eco

- Eco Park

- Eco Park Stadium

- Eco-Power Stadium

- Ecolab

- economic impact

- economic pressures

- economic recovery

- economic suffering

- economically

- economy

- eCooltra

- ECOsmart

- Ecuador

- Ed Lister

- Ed Lunger

- Ed Woodward

- EDAG Group

- Eddie DeLoach

- Eden Gardens

- Eden Park

- EDG

- Edgar Bove

- Edgar Rathbone

- Edgbaston

- Edgbaston Cricket Ground

- Edgbaston Stadium

- EDGE Sports Group

- edge-to-cloud

- Edgeley Park

- Edinburgh

- Edinburgh International Arena

- Edinburgh Rugby

- Edmonton

- Edmonton Prospects

- Edmund F Murphy III

- Eduardo Barella

- Eduardo Zamarripa

- Education City

- Education City Stadium

- Edward Gaming

- Edward M. Augustus Jr.

- Edwards Family

- EE

- Eerste Divisie

- EFL

- EFL Green Clubs

- EFL League One

- EFL League Two

- Egypt

- EHC Red Bull Munich

- EHF

- EHF EURO 2024

- EHF FINAL4

- EIF

- Eindhoven

- Eindhoven University of Technology

- Eintracht Frankfurt

- EintrachtTech

- EIR

- Eisbären Berlin

- Eishockey-Löwen

- Ekaterinburg Arena

- Ekstraklasa

- El Campín Stadium

- El Clásico

- El Kraken

- El Molinón Stadium

- El Monumental

- El Paso

- El Paso Chihuahuas

- El Sadar

- El Sadar Stadium

- El Salvador

- El Volcán

- Eladio Rosabal Cordero in Heredia

- Elavon

- Elche CF

- electricity

- Electronic Line Calling

- Elena Lapushkina

- Elevate Sports Ventures

- Eleven Park

- Eleven Sports Media

- ELF

- Eli Hoisington

- Elior

- Elizabeth Olympic Park

- Elland Road

- Elliott T. Bowers Stadium

- Ellis Park Stadium

- Elysian Park

- Elysian Park Ventures

- emblems

- Emerald Publishing

- Emilia-Romagna Open

- Emilio Azcárraga

- Emilio Gayo

- Emirates

- Emirates Airlines

- Emirates Cricket Board

- Emirates Dubai 7s stadium

- Emirates Flight Catering

- Emirates Group

- Emirates Old Trafford

- Emirates Old Trafford Cricket Ground

- Emirates Stadium

- Emirates Stadium Virtual Tour

- Emma Beaugeard

- Empire State Development Corporation

- Empoli

- Empower Field at Mile High

- Empower Retirement

- Empty stadiums

- Emrill

- Endeavor

- Endeavor Group

- Endeavor Group Holdings

- Energa

- engagement

- engaging

- ENGIE

- engineering

- engineering service

- England

- England and Wales Cricket Board

- English

- English Cricket Board

- English Football Association

- English Football League

- English League Cup

- English Premier League

- English Premiership

- enhance

- Enmarket Arena

- Ennio Tardini Stadium

- Enno Tardini Stadium

- Entain plc

- ENTEGA AG

- ENTEGA VIP lounge

- Enterprise Center

- entertainment

- entertainment and leisure destination

- entertainment arena

- entertainment businesses

- entertainment center

- Entertainment company

- entertainment complex

- entertainment destination

- entertainment destinations

- entertainment district

- entertainment facilities

- entertainment hub

- entertainment plaza

- entertainment venues

- entrepreneurship in tourism

- entry lane

- Environment

- environmental

- Environmental Accreditation

- Environmental Impact Report

- Environmental Program

- Environmental Sustainability

- environmental-friendly

- environmentalist

- environmentally

- environmentally friendly

- Envy Gaming

- EOP Architects

- EPCR

- EPCR Challenge Cup

- EPIC

- Epicenter

- EPL

- Eppstein Uhen Architects

- eps

- eps international GmbH

- equity platform

- Erdgas Sportpark

- Eredivisie

- Eric Blockie

- Eric Garcetti

- Eric Samuelson

- Ericsson

- Erik Greupner

- Ernst and Young

- Ernst Happel Stadium

- Ernst-Abbe-Sportfeld

- Ernst-Abbe-Sportfield

- Ernst-Happel-Stadium

- ERRE

- error

- Ersal Ozdemir

- Erzgebirge Aue

- Es Con Field Hokkaido

- ES:ME

- ES:ME Entertainment Services

- ESA

- Escapade Living

- Escapade Silverstone

- ESG

- ESL

- ESL Gaming

- ESP ESports Experience Center

- Espai Barça

- Espérance Sportive Troyes Aube Champagne

- ESPN

- ESPN Events

- ESPN Wide World of Sports Complex

- ESPN’s Wide World of Sports Complex

- Esporte Clube Bahia

- esports

- esports and gaming venue

- Esports Arena

- Esports event

- esports gaming arena

- Esports Global

- esports hub

- esports infrastructure platform

- esports island

- esports stadium

- esports tournament

- Esports venue

- esports venues

- Esports World Cup

- esports zone

- ESS

- ESTAC

- Estadi Ciutat

- Estadi Ciutat de València

- Estadi Ciutat de Valencia Stadium

- Estadi Johan Cruyff

- Estadi Mallorca

- Estadi Mallorca Son Moix

- Estadi Nou Mestalla

- Estadi Olimpic Lluis Companys

- Estadio 15 de Abril

- Estadio Abanca-Riazor

- Estadio Akron

- Estadio Alberto J Armando Stadium

- Estadio Alejandro Morera Soto

- Estadio Alfredo di Stéfano

- Estadio Alfredo Harp Helú

- Estadio Azteca

- Estadio BBVA Bancomer

- Estadio Centenario

- Estádio Cícero Pompeu de Toledo

- Estadio Ciudad de Vicente López

- Estadio Cuscatlán

- Estadio de la Cartuja

- Estadio de Mazatlán

- Estádio do Dragão

- Estádio do Pacaembu

- Estadio Jorge Luis Hirschi

- Estádio Jornalista Mário Filho

- Estadio José Zorrilla

- Estadio La Cartuja

- Estadio León

- Estadio Libertador Simón Bolivar

- Estadio Mario Kempes

- Estadio Mâs Monumental

- Estadio Monumental

- Estadio Monumental David Arellano

- Estadio Municipal de Can Misses

- Estádio Nacional

- Estadio Nemesio Camacho El Campín

- Estadio Nuevo Mirandilla

- Estadio Nuevo Pepico Amat

- Estádio Olímpico do Pará

- Estadio Pedro Bidegain

- Estadio Pucela

- Estadio Ramón ‘Tahuichi’ Aguilera Costas

- Estadio Ramón de Carranza

- Estadio San Carlos de Apoquindo

- Estadio Santiago Bernabéu

- Estadio Único Madre de Ciudades

- Estudiantes

- Estudiantes de La Plata

- ESY

- ETFE

- Ethara

- Etihad

- Etihad Abseil

- Etihad Airways

- Etihad Airways Abu Dhabi Grand Prix

- Etihad Arena